In France, and in other countries around the world, it is forbidden to drive without insurance. If you are caught driving a vehicle, the penalties can be very severe. Furthermore, in the event of an accident, the law will be uncompromising towards the driver and the uninsured car which is responsible.

What is car insurance?

Automobile coverage is mandatory for all owners of motor vehicles. It was in February 1958 that the law put in place this system which requires insurance for all vehicles traveling on public roads. The principle is simple: the insured pays a contribution to an insurance company in exchange for financial compensation in the event of a loss provided for in the contract.

Car insurance will cover the car, the driver and passengers for any damage caused to a third party.

To reinforce its importance, the obligation to hold this document has even been integrated into the Highway Code and the Insurance Code.

This obligation concerns all motorized land vehicles as well as trailers . These can include utility cars, buses, tractors or other agricultural machinery, but also two and three wheels.

What type of insurance to take out?

“Automobile liability” or “third party insurance” is the minimum car insurance imposed by law . It will cover any damage you may cause to a third party by driving or parking the vehicle.

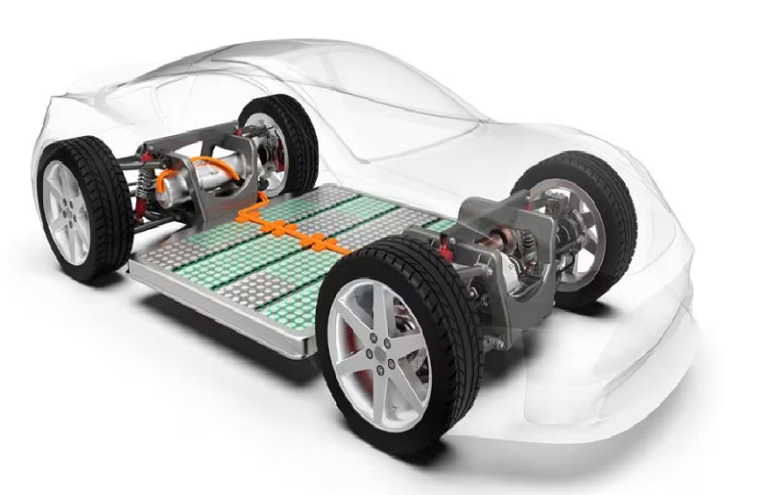

This compulsory insurance is basic coverage for physical harm, material and immaterial damage that could occur on public roads. It also concerns non-running cars, if they contain fuel or a battery. These elements can still cause an explosion which can injure others.

If you are the victim of an accident, it will be up to the insurance of the driver responsible to cover the damage. If you cause an accident, the damage will be covered by your insurance. The civil liability guarantee will therefore cover damage caused by children or an occasional driver.

However, this assurance has limits. It will not cover damage you have caused to yourself or your family, the tranport of dangerous materials or damage caused intentionally.

Driving on a circuit and driving without a license are also excluded from this civil liability guarantee. If you encounter this situation, all reimbursements will be your personal responsibility.

Third party insurance +

The minimum guarantee is then combined with other guarantees to protect you from different types of risks. Third-party insurance+ is known as an intermediate offer to insure your vehicle.

You can add other types of guarantees to this insurance to provide better coverage for the driver and the car.

The “glass breakage” warranty is the most common coverage that owners associate with the basic warranty.

Car insurance is generally accompanied by an “assistance guarantee” which will be very useful in the event of an accident or breakdown. When comparing several insurers, it is important to take into account the mileage excess linked to assistance.

All Risks Insurance

This insurance formula includes the base, but also options covering different types of accidents. It even guarantees coverage for “responsible claims”, in the event that it is the insured who caused the accident.

+ There are no comments

Add yours